Loan Origination System

Built on Microsoft Dynamics 365/Power Apps.

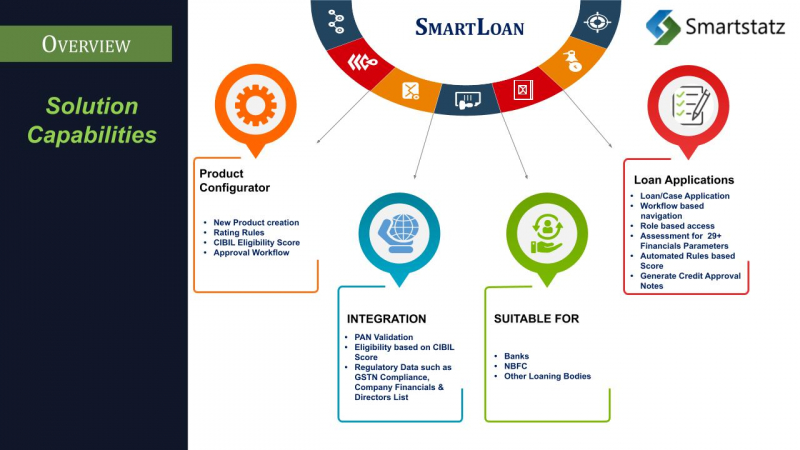

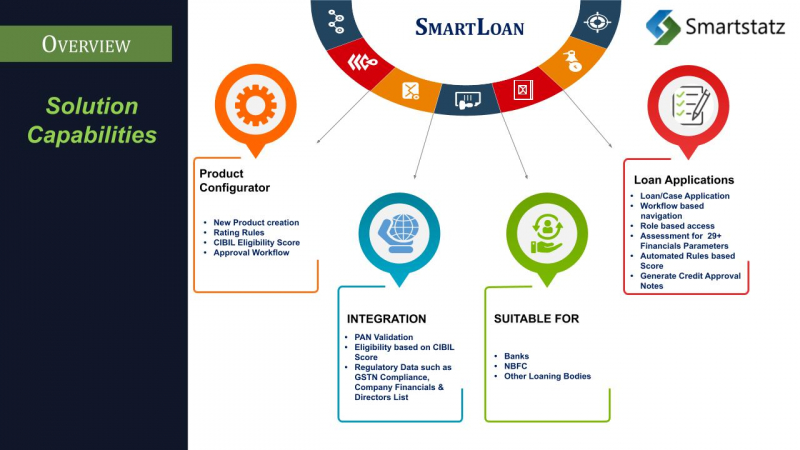

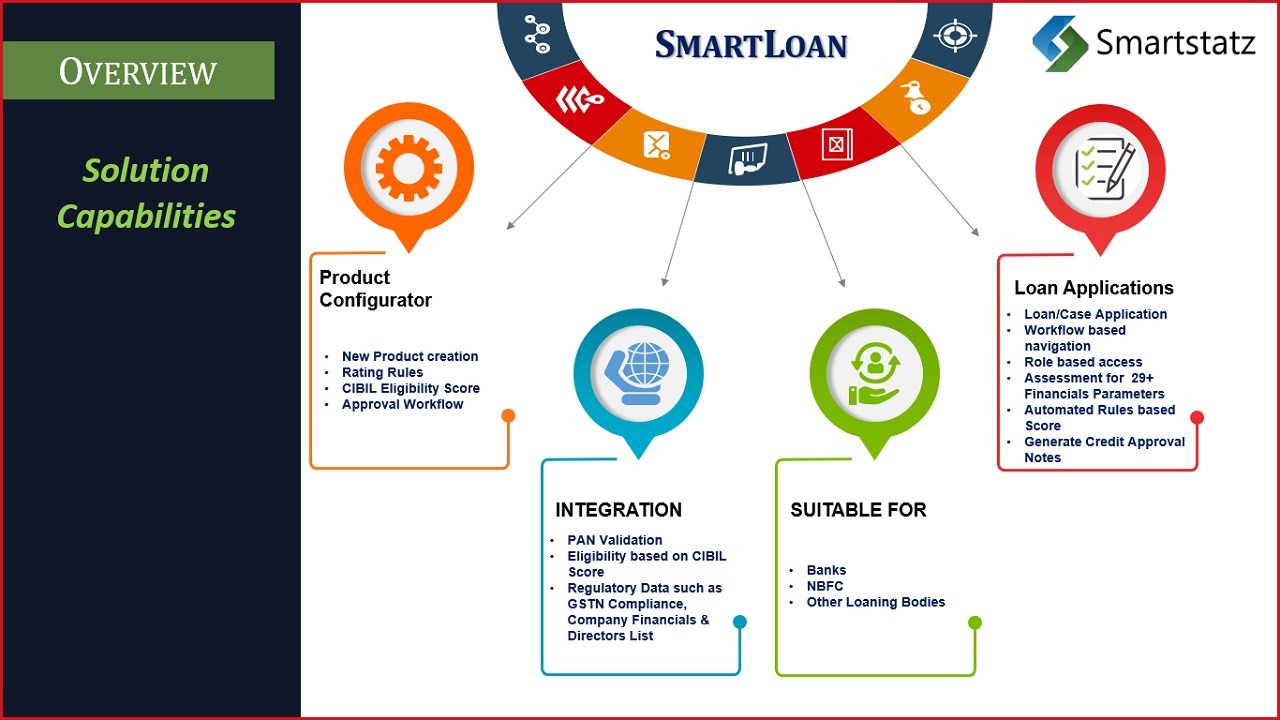

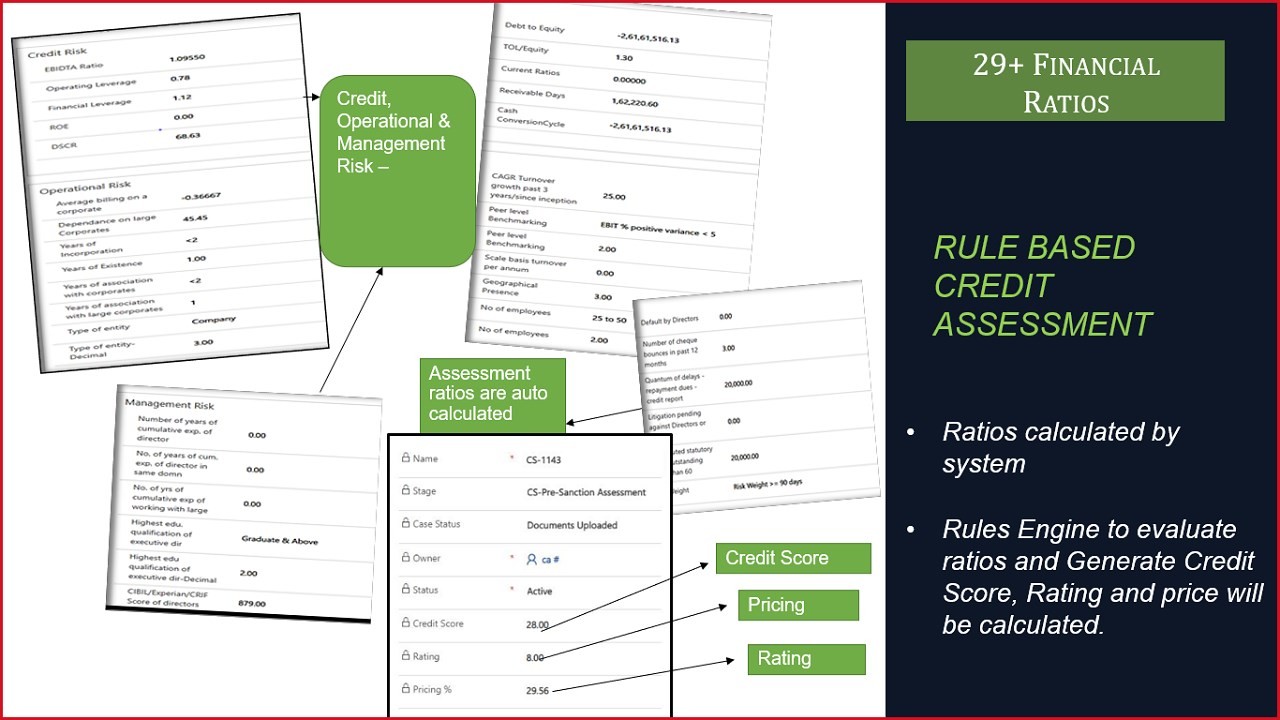

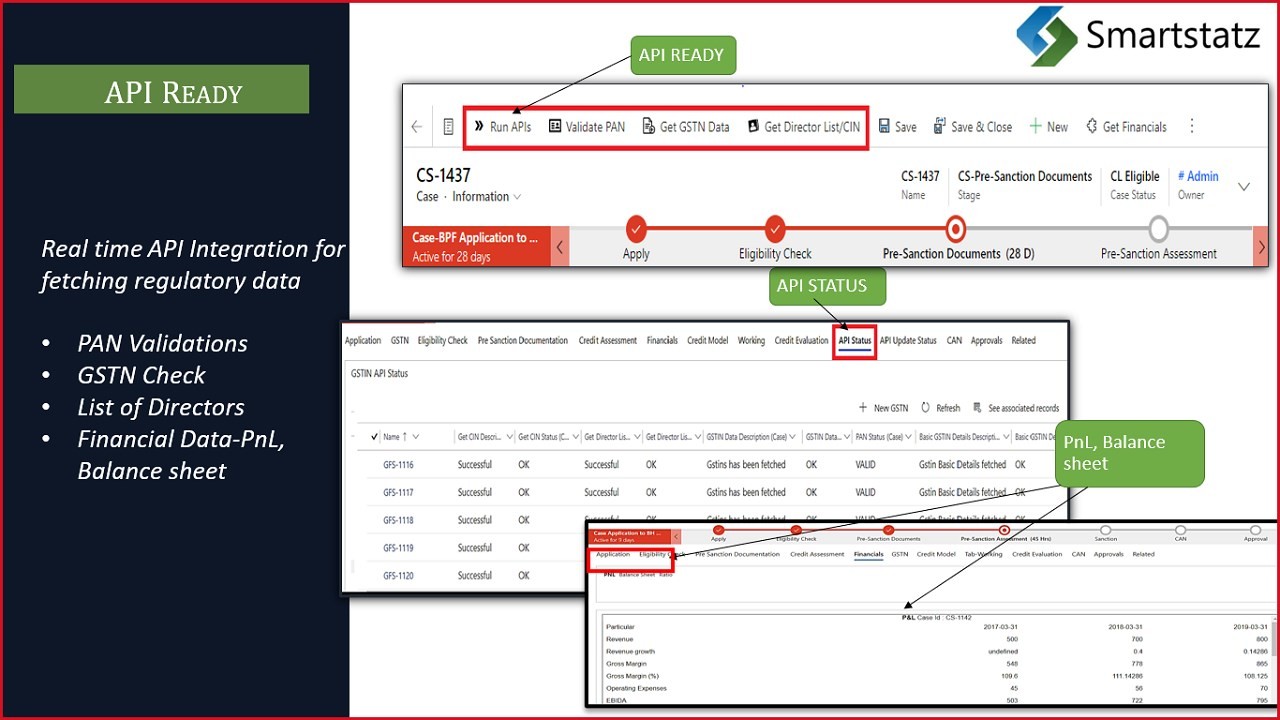

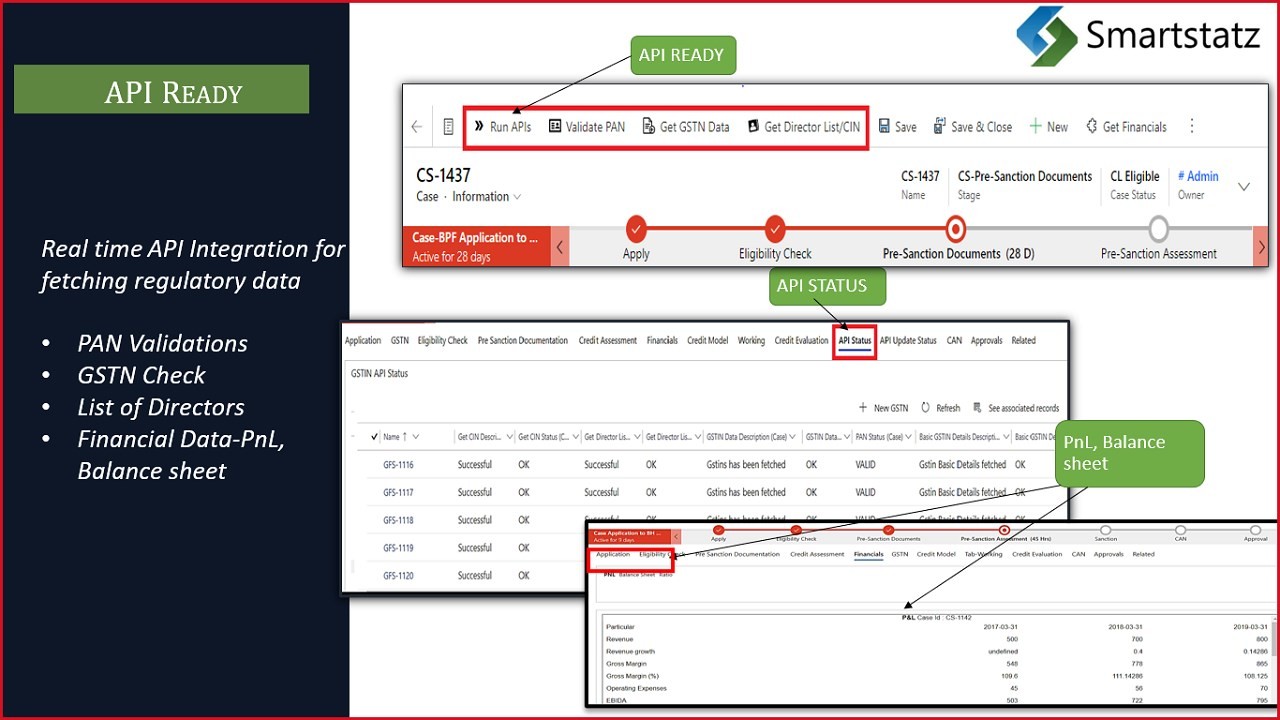

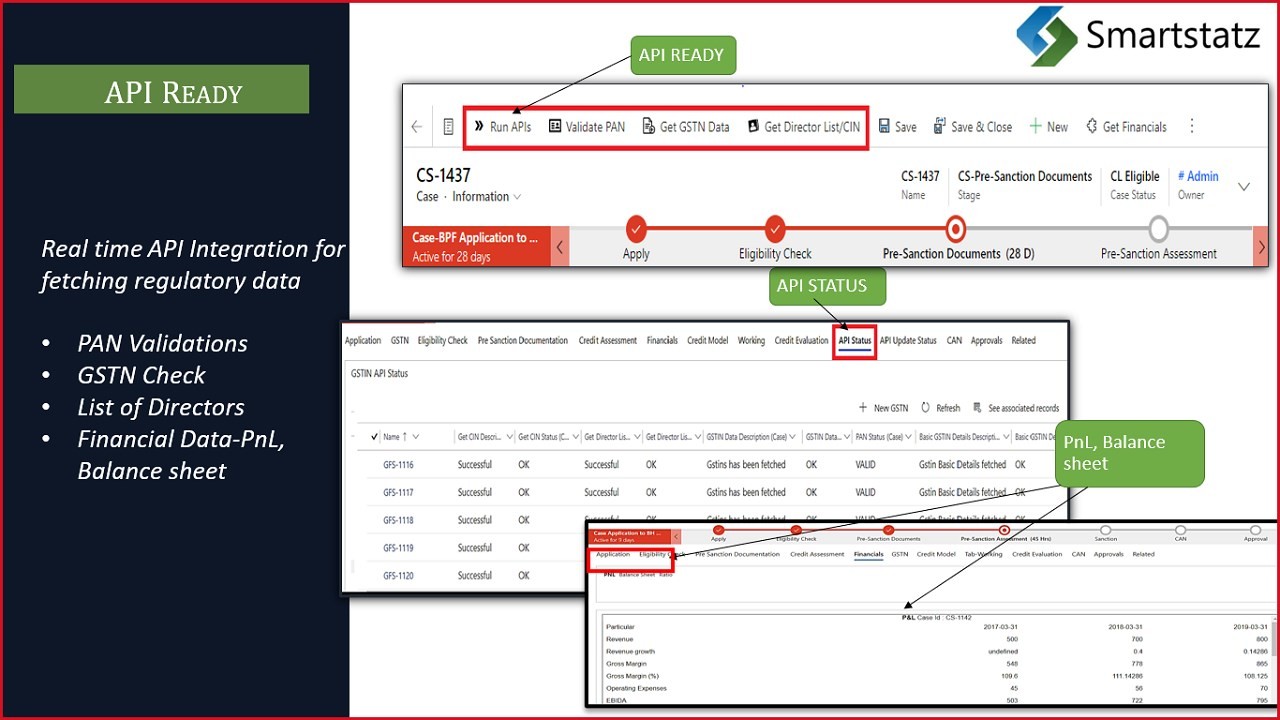

CAPABILITIES & FEATURES

Built on Microsoft Dynamics 365/Power Apps.

Conquer every stage of the customer journey with Smart Statz CRM completely free CRM at its core the customer They’re powerful alone

Copyright @ SMARTSTATZ. All Rights Reserved by